Hamilton County Property Taxes Due Date . Locate your property using the search options above, then click register bill and follow the prompts to create an account. The third property tax installment plan. Unlike ohio's property taxes, bills in kentucky are paid in full. Physical copies of tax bills. And taxes on manufactured homes are due in march and july. Pay real estate taxes online. Second half tax bills due: Receive a 3% discount on payment of property taxes and/or tangible personal property taxes. If the taxes are not paid by the date set for the tax deed sale, the property is sold by the clerk of courts' office to the highest bidder. Taxes on real estate are due in january and june of each year. The first half of those.

from www.keatax.com

Taxes on real estate are due in january and june of each year. Pay real estate taxes online. The third property tax installment plan. Unlike ohio's property taxes, bills in kentucky are paid in full. The first half of those. Locate your property using the search options above, then click register bill and follow the prompts to create an account. Second half tax bills due: Physical copies of tax bills. Receive a 3% discount on payment of property taxes and/or tangible personal property taxes. If the taxes are not paid by the date set for the tax deed sale, the property is sold by the clerk of courts' office to the highest bidder.

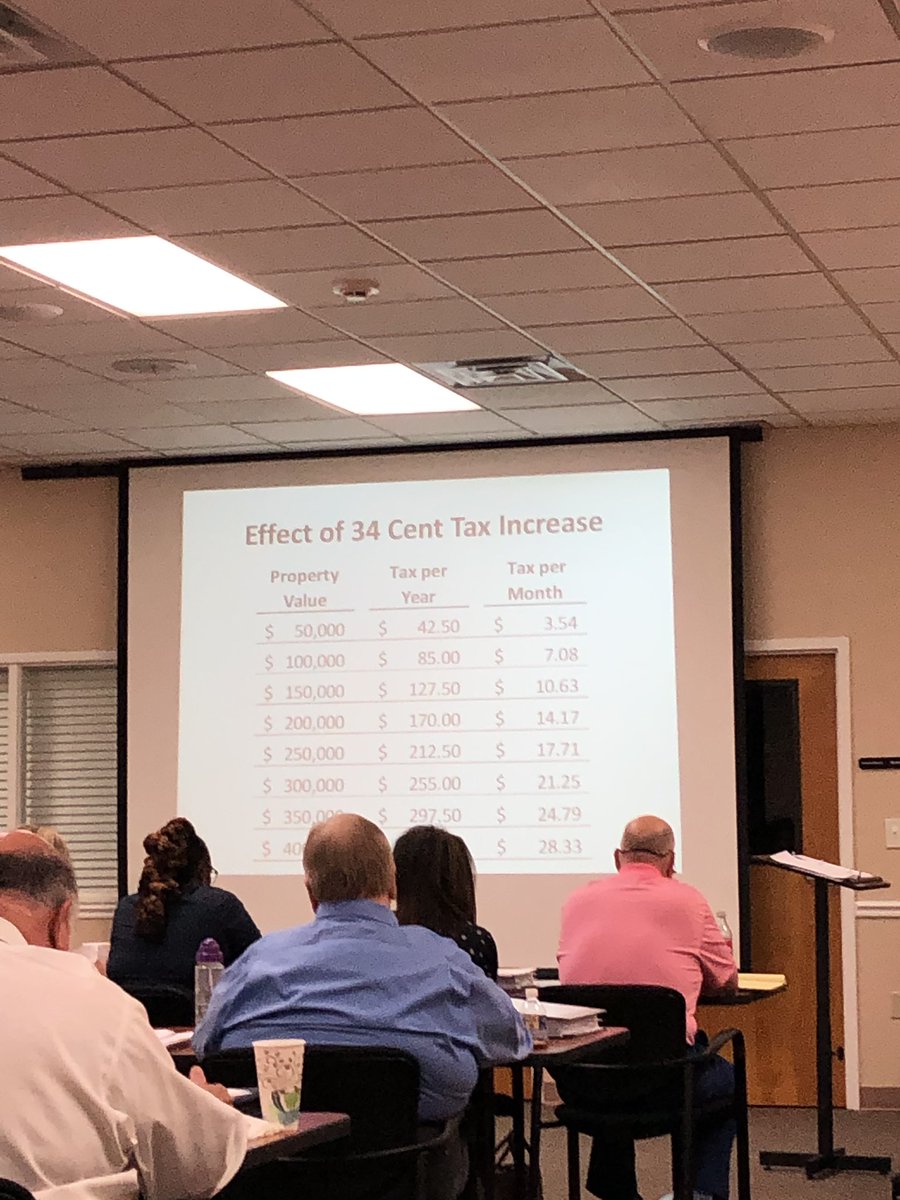

Mayor Proposes New 34 Cent Hamilton County Property Tax KE Andrews

Hamilton County Property Taxes Due Date Unlike ohio's property taxes, bills in kentucky are paid in full. And taxes on manufactured homes are due in march and july. Physical copies of tax bills. The third property tax installment plan. If the taxes are not paid by the date set for the tax deed sale, the property is sold by the clerk of courts' office to the highest bidder. Pay real estate taxes online. Taxes on real estate are due in january and june of each year. The first half of those. Receive a 3% discount on payment of property taxes and/or tangible personal property taxes. Locate your property using the search options above, then click register bill and follow the prompts to create an account. Unlike ohio's property taxes, bills in kentucky are paid in full. Second half tax bills due:

From radio.wosu.org

Hamilton County Property Owners Get More Time To Pay Taxes WOSU Radio Hamilton County Property Taxes Due Date If the taxes are not paid by the date set for the tax deed sale, the property is sold by the clerk of courts' office to the highest bidder. Physical copies of tax bills. The third property tax installment plan. Taxes on real estate are due in january and june of each year. Pay real estate taxes online. And taxes. Hamilton County Property Taxes Due Date.

From www.wlwt.com

Hamilton County property owners score with rebate Hamilton County Property Taxes Due Date Receive a 3% discount on payment of property taxes and/or tangible personal property taxes. Second half tax bills due: The third property tax installment plan. If the taxes are not paid by the date set for the tax deed sale, the property is sold by the clerk of courts' office to the highest bidder. Pay real estate taxes online. Unlike. Hamilton County Property Taxes Due Date.

From www.wcpo.com

Hamilton County property tax collection delayed until July 17 Hamilton County Property Taxes Due Date Physical copies of tax bills. Receive a 3% discount on payment of property taxes and/or tangible personal property taxes. Taxes on real estate are due in january and june of each year. And taxes on manufactured homes are due in march and july. If the taxes are not paid by the date set for the tax deed sale, the property. Hamilton County Property Taxes Due Date.

From assessor.hamiltontn.gov

Hamilton Co. WebPro50 Hamilton County Property Taxes Due Date Locate your property using the search options above, then click register bill and follow the prompts to create an account. Pay real estate taxes online. And taxes on manufactured homes are due in march and july. If the taxes are not paid by the date set for the tax deed sale, the property is sold by the clerk of courts'. Hamilton County Property Taxes Due Date.

From alloutmoves.com

Chattanooga & Hamilton County, TN Property Taxes 💸 2024 Ultimate Hamilton County Property Taxes Due Date Taxes on real estate are due in january and june of each year. Unlike ohio's property taxes, bills in kentucky are paid in full. Locate your property using the search options above, then click register bill and follow the prompts to create an account. The first half of those. Receive a 3% discount on payment of property taxes and/or tangible. Hamilton County Property Taxes Due Date.

From tooyul.blogspot.com

Pay Hamilton County Ohio Property Taxes Online Tooyul Adventure Hamilton County Property Taxes Due Date The third property tax installment plan. If the taxes are not paid by the date set for the tax deed sale, the property is sold by the clerk of courts' office to the highest bidder. Receive a 3% discount on payment of property taxes and/or tangible personal property taxes. Second half tax bills due: Pay real estate taxes online. And. Hamilton County Property Taxes Due Date.

From eloraqmyrtia.pages.dev

Property Tax Due Date 2024 Ermina Diannne Hamilton County Property Taxes Due Date And taxes on manufactured homes are due in march and july. Physical copies of tax bills. Pay real estate taxes online. Locate your property using the search options above, then click register bill and follow the prompts to create an account. Second half tax bills due: Taxes on real estate are due in january and june of each year. The. Hamilton County Property Taxes Due Date.

From www.hamilton.ca

Understanding Your Property Tax Bill City of Hamilton Hamilton County Property Taxes Due Date Receive a 3% discount on payment of property taxes and/or tangible personal property taxes. Second half tax bills due: If the taxes are not paid by the date set for the tax deed sale, the property is sold by the clerk of courts' office to the highest bidder. Locate your property using the search options above, then click register bill. Hamilton County Property Taxes Due Date.

From bellmoving.com

Hamilton County Ohio Property Tax 🎯 2024 Ultimate Guide & What You Hamilton County Property Taxes Due Date Taxes on real estate are due in january and june of each year. And taxes on manufactured homes are due in march and july. If the taxes are not paid by the date set for the tax deed sale, the property is sold by the clerk of courts' office to the highest bidder. The first half of those. Physical copies. Hamilton County Property Taxes Due Date.

From www.wcpo.com

Here's how to find your new Hamilton County property value and tax bill Hamilton County Property Taxes Due Date The first half of those. Unlike ohio's property taxes, bills in kentucky are paid in full. The third property tax installment plan. And taxes on manufactured homes are due in march and july. Taxes on real estate are due in january and june of each year. Receive a 3% discount on payment of property taxes and/or tangible personal property taxes.. Hamilton County Property Taxes Due Date.

From pastureandpearl.com

When Are Property Taxes Due In Cook County June 2024 Hamilton County Property Taxes Due Date Locate your property using the search options above, then click register bill and follow the prompts to create an account. The first half of those. The third property tax installment plan. If the taxes are not paid by the date set for the tax deed sale, the property is sold by the clerk of courts' office to the highest bidder.. Hamilton County Property Taxes Due Date.

From news.yahoo.com

DWYM Hamilton County Property Taxes Hamilton County Property Taxes Due Date The first half of those. Second half tax bills due: Locate your property using the search options above, then click register bill and follow the prompts to create an account. Physical copies of tax bills. Taxes on real estate are due in january and june of each year. The third property tax installment plan. And taxes on manufactured homes are. Hamilton County Property Taxes Due Date.

From www.wcpo.com

Hamilton County property tax rebate still less than promised Hamilton County Property Taxes Due Date Unlike ohio's property taxes, bills in kentucky are paid in full. Physical copies of tax bills. The third property tax installment plan. Receive a 3% discount on payment of property taxes and/or tangible personal property taxes. Locate your property using the search options above, then click register bill and follow the prompts to create an account. Second half tax bills. Hamilton County Property Taxes Due Date.

From www.youtube.com

Apply for Missing Property Tax Savings YouTube Hamilton County Property Taxes Due Date And taxes on manufactured homes are due in march and july. The third property tax installment plan. Second half tax bills due: Pay real estate taxes online. Locate your property using the search options above, then click register bill and follow the prompts to create an account. Taxes on real estate are due in january and june of each year.. Hamilton County Property Taxes Due Date.

From cincinnatilivingonline.com

Hamilton County Property Tax Reassessment The Alison Moss Group Hamilton County Property Taxes Due Date And taxes on manufactured homes are due in march and july. Second half tax bills due: If the taxes are not paid by the date set for the tax deed sale, the property is sold by the clerk of courts' office to the highest bidder. The third property tax installment plan. Pay real estate taxes online. Receive a 3% discount. Hamilton County Property Taxes Due Date.

From www.chattnewschronicle.com

Hamilton County Property Taxes are DueAre You Taking Advantage of Hamilton County Property Taxes Due Date Pay real estate taxes online. Locate your property using the search options above, then click register bill and follow the prompts to create an account. Unlike ohio's property taxes, bills in kentucky are paid in full. Taxes on real estate are due in january and june of each year. The third property tax installment plan. If the taxes are not. Hamilton County Property Taxes Due Date.

From www.pinterest.com

Hamilton County UPDATE Property Tax Deadline DELAYED to July 17, 2020 Hamilton County Property Taxes Due Date Taxes on real estate are due in january and june of each year. Second half tax bills due: Physical copies of tax bills. And taxes on manufactured homes are due in march and july. Receive a 3% discount on payment of property taxes and/or tangible personal property taxes. The third property tax installment plan. If the taxes are not paid. Hamilton County Property Taxes Due Date.

From chicagocrusader.com

First Installment Cook County property taxes due date pushed to April 3 Hamilton County Property Taxes Due Date Second half tax bills due: The third property tax installment plan. Physical copies of tax bills. Taxes on real estate are due in january and june of each year. And taxes on manufactured homes are due in march and july. The first half of those. Unlike ohio's property taxes, bills in kentucky are paid in full. Receive a 3% discount. Hamilton County Property Taxes Due Date.